I know what you’re thinking. “Online quotes lie? That’s a bit strong, isn’t it?”

And which online quotes? What websites? Who are we talking about?

The purpose of this article is not to point fingers, or call someone out, or even to say that what they are telling you is technically incorrect.

The point is that what you get may not be what you think you’re getting.

Sound confusing? Let me tell you what I mean.

The Two Types of Online Quotes

When you go to a website that sells insurance and click the QUOTE button, you will typically get one of two options.

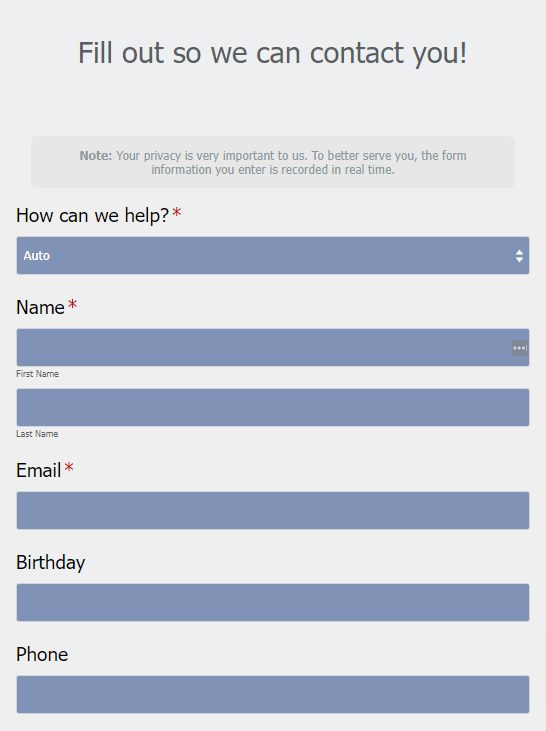

The first option is you get a form that looks like this or something similar.

This option simply takes your information and gives it to a person to do your quote. It really isn’t any different than calling or going into an office,

If there is a difference, it is convenience. You are able to give the information the agent needs and wait for them to contact you, either with a completed quote or to get the rest of the information, depending on how detailed the form might be.

So that’s easy to understand. But what is the other kind of online quote?

The second option is the comparative rater (like these).

You know the quote is from a comparative rater when it promises to give you NUMBERS as soon as you fill out a form.

There is no waiting for a call back, no setting up an appointment, no emails back and forth.

It’s click, type, choose, done.

The entire purpose of a comparative rater is to show you a number you’ll like, have you select the policy based on that number, and have you buy it immediately without consulting an agent.

The whole purpose of this blog is to tell you why that’s a bad idea.

How Comparative Raters Work

When you put your information into a comparative rater, it takes that info and sends it to insurance companies (carriers) to get prices.

What carriers depends on:

- Your State (Different states have different carriers)

- Rater from a carrier (Progressive, GEICO, etc.) or an agency (Alliance, etc.)

- Agreements between an agency and carriers

- Integrations between a carrier and the rating software

So a lot goes into what results you get from a rater. Let’s simplify it a little.

If you go to a company like Allstate and ask for a quote, they are going to give you a quote from Allstate. Pretty simple.

If you go to a website like The Zebra and ask for a quote, they give you several quotes based on what state you’re in.

If you go to an independent insurance agency that uses a rater, you’ll get quotes from whatever companies they write and that support the rater.

Why am I telling you all of this?

Because what you see is not always what you can get.

Even from companies or agencies that represent dozens of carriers, unless they work with the website or rating software you won’t see them.

“But so what?” you may say. “All that matters is the price on the quote – right?”

Wrong.

Too Good To Be True?

You’ve put your name, address, phone number, email, best friend’s high school sweetheart’s name and your dog’s favorite treat type and finally, at long last, you get your quote.

And the price is AMAZING.

How? Why? WHO CARES!

You’re saving $200 a year. No, $400. No, $1,000!!!

Your credit card appears in your hand as if you were a magician and, with a flourish, you put the number in to seal the deal but-

WAIT.

My father used to tell me, “If something looks too good to be true, it usually is.”

But how? You put your info in and you got your quote. You may have even uploaded your declaration page from your existing policy.

So what’s different?

The Switch

Like a good card trick, an online quote can be a case of misdirection.

You think you know what you’re buying. But it might not be the same thing after all.

Your apples to apples quote may actually be apples to oranges.

Check the quote against the policy you have now.

Many online quotes start with lower coverage amounts.

It goes like this:

Your quote is $500 a year cheaper. But when you check your policy you see you currently have 100/300 coverage. But the quote is for 30/60.

Your quote is cheaper because you’re buying less insurance!

Make sure the quote is for the coverage you want.

The last thing you want to do is save some money up front, but then owe a lot out of pocket if you have a claim.

My Own Personal Experience

If you read nothing else in this blog, read this!

I’m not writing this blog based on some agenda or to get you to only get quotes with Alliance – though I really hope you do ask us for a quote!

I’m writing this because it happened to me. Yes, even insurance pros get fooled by comparative raters.

I was curious about how some of the new online websites that promise great insurance rates worked, so I got a quote for myself – auto & home.

The results were astounding. I was going to save $1,000 a year on my homeowners insurance!

Even I was about to fire myself as my own agent and go with whatever company was offering this great deal (in this case, MetLife/Farmers).

But when I double checked the coverages, they were WAY OFF.

My homeowners coverage was almost $200,000 dollars lower than what I currently had! I would have been underinsured, meaning I would not be able to build my house back if I lost it in a fire or another disaster.

I tried to change it but I couldn’t – the quote had a maximum value that it would offer.

So instead of giving me a quote based on what I currently had (I even uploaded my dec pages so the rater knew my current limits) it gave me a price based on a weaker policy.

How about an analogy?

Let’s say you were buying a car online, and you currently had a car worth $40,000. You wanted a car worth the same, but newer.

The car selling website gives you a price and you think, WOW! A $40,000 car for only $30,000!

But when you pick it up, it’s actually JUST A $30,000 car. Different model, different year, different everything.

Wouldn’t you be furious?

How can this be? How do websites and raters get away with this?

Why This Happens

It happens because companies bank on the fact that consumers just like you don’t know insurance.

They think you don’t know the difference between 100/300 auto coverage and 30/60 for auto coverage (we explain that here.)

They think you don’t know why you need Replacement Cost vs Actual Cash Value (we go over that here.)

They are sure you don’t know why your homeowners coverage should be based on Replacement Cost vs Market Value (like we talk about here.)

The point is companies know that insurance is, well, boring. People don’t like to read up on it and trust their agent to guide them to what they need.

But without an agent, the only thing most people look for is PRICE.

But, as you know, price can be misleading.

What Should You Do?

Well, it should be obvious. Use an agent.

Insurance usually isn’t the kind of thing that you need to buy right here, right now. It isn’t, “Grab some diapers on the way home, there’s been a blowout.”

Insurance is a product designed to protect you, your life, your stuff.

Life is complicated. Life is messy. Life is unique.

What you need isn’t what your brother or sister or best friend needs.

So take more than fifteen minutes on a website to find the best deal that actually gives you the coverage you need.

And the right agency won’t just help you with that. They’ll tell you WHY they recommend what they offer you and educate you through the whole process.

You deserve a great policy and a great price. And you deserve to be treated like a valuable client and person, not just another click on a page or another $200/a month.

So click the button below. Yes, it’s a quote request button. Yes, it leads you to a form.

But there is a person on the other side of that form that can just flat out make your life better.

No lie.