Your Castle. Your Keep. Your Rock. Protect It.

If you’re like most homeowners in our backyard of Winston-Salem, NC, your home is your most valuable asset. If something happens to your house, townhouse or condo, you want to know that it is protected, no matter what happens.

Getting the right coverages in your home insurance policy isn’t just a luxury, it’s a necessity. But, if you’re like most people, you don’t exactly spend your free time moonlighting as an insurance agent. So what do you do?

The first step is educating yourself on the basics of what a homeowners insurance policy really does. The second step is finding an agent who can advise you further and help you get the policy you need.

We help homeowners throughout the entire eastern seaboard, so no matter what you’re thinking about, we’ve probably been there, seen it, and helped someone just like you. So let’s help you with the first part, the education, and then see about the second part later.

At heart, homeowners insurance is about protecting your home, your possessions, the buildings on the land around your home, and protecting you from lawsuits and other forms of liability exposure.

That’s a lot of coverage for one policy, so let’s explore a little more.

Note: if you are looking for homeowners insurance for a rental property, or home that is currently vacant, you cannot use traditional homeowners insurance. You need a “specialty dwelling” policy – just contact us and we’ll walk you through it. Also, if you are a renter, just go here to learn more about renters insurance.

Before we go on, if you just want a QUOTE now, click here.

Why It Matters

Regardless of whether you live in North Carolina or any of the other states we cover, homeowners insurance is one of the most important insurance policies you could ever own. A house is the most valuable asset most of us will ever have, so making sure it’s protected is key to protecting your financial future.

It’s important to understand that no two homeowners insurance policies are created equal though. Different insurance companies offer different levels of coverage, different endorsements and riders, and have different conditions and limitations.

We will cover some of these in a later blog, so for now let’s focus on the basics that will be in every policy – no matter the company.

Homeowners Insurance Basics

Whether you own or rent, insuring the place you call home can help protect you financially if you suffer a loss due to fire, theft, vandalism, or other covered events. It will also cover you in the event someone is injured while on your property and wins a legal judgment against you.

Homeowners insurance policies differ by which losses are covered, which coverages you choose, and what type of residence you own. You choose which policy is best for you, whether it’s a policy that covers losses such as fire, hail, smoke, falling objects, vandalism and theft of personal property, or whether it’s a policy that covers only specified losses.

At Alliance, we always recommend the broader coverages that protect against as many risks as possible, and only write more limited policies in very specific instances. And remember, we cover your home for what it would cost to rebuild, not what someone might pay for it.

We explain this further in our article about Market Value vs Replacement Cost.

Different Kinds of Homeowner Policies

Let’s say you are discussing a new homeowners policy with two different agents. One offers you a policy for $1,000 a year, and the other offers you what you think is the same policy for $800 a year. It’s a no brainer, right? It sure is – IF they are the same kinds of policies.

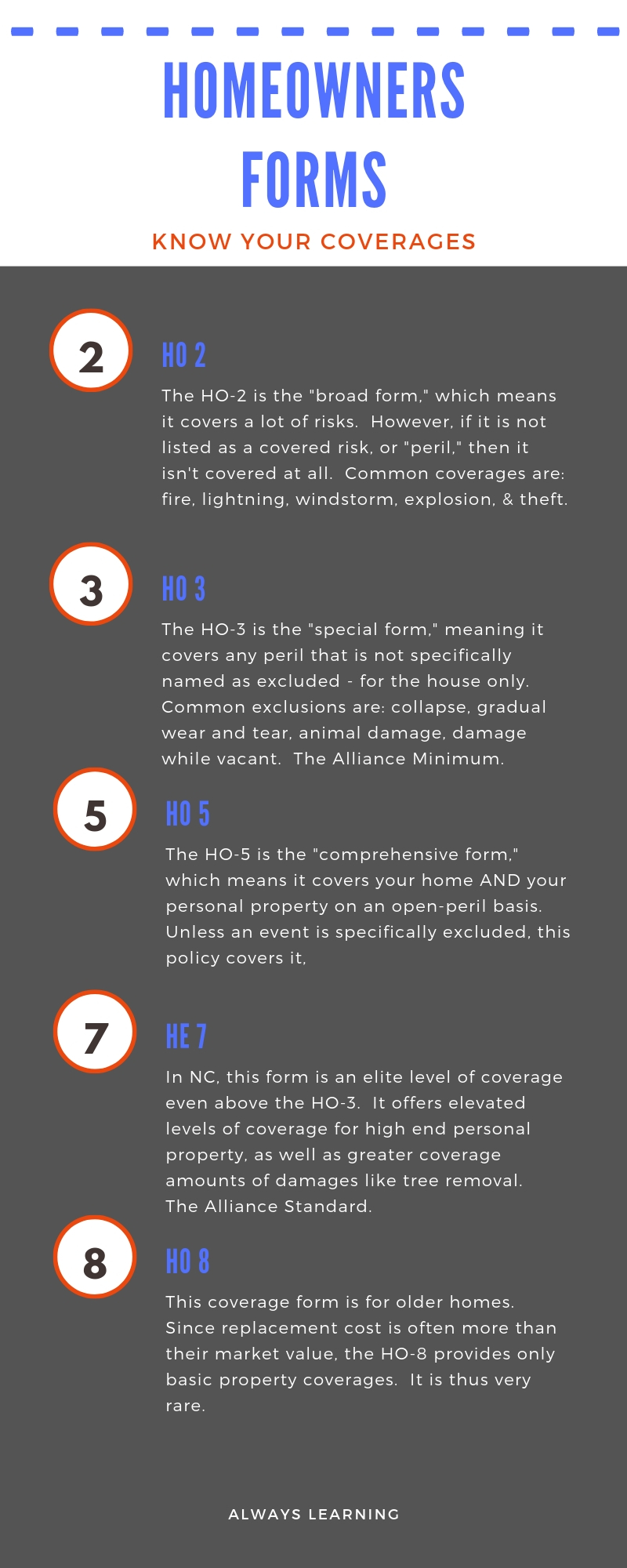

Homeowners policies are divided into different levels of coverages, in the insurance industry called forms. At the most basic level you have what is called an HO-2, a form that offers protection only against risks that are specifically named on your policy.

The standard form is the HO-3, a fantastic policy that provides coverage for a wide range or terrible things that can happen to a home. In fact, the reason it is the standard is because a risk has to be specifically excluded from the policy to not be covered.

Note: Personal property is NOT included in this “open-peril” coverage, and is instead still covered on a “named peril” like an HO-2. This policy is the bare minimum that Alliance will write.

In the example we used above, if the $800 policy is an HO-2, and the $1,000 policy is an HO-3, then you would have to really decide if losing that protection would be worth $200 a year. We would never suggest it.

If you’re looking for blanket protection against as much risk as possible, then the HO-5 is for you. It provides open-peril coverage for both your house and the personal property you own. And if you want even more coverage, upgrade to an HE-7 (in NC only – other states typically have a similar policy under a different name). This gold standard level policy offers enhanced coverage amounts for Coverage B & C, as well as increased values for high risk items such as jewelry, furs, cash, computers and more.

What is Coverage B? Or C?

Glad you asked. Read on.

Policy Breakdown: Homeowners Insurance Coverages

If you look at your homeowners policy, here are the coverages you will see.

Coverage A: Dwelling — this is the portion of your policy that covers the actual structure (main house). The cost to replace your home can fluctuate from time to time based on the cost of raw material and labor, and of course, supply and demand.

We’ll run a replacement cost analysis on your home to see how much it would actually cost if the worst happened and you had to rebuild. While some policies allow you to insure your home for less than what your replacement cost might be, most do not.

And even if they do, Alliance NEVER allows this, as we can’t in good conscience watch someone loose everything and be short thousands of dollars because they wanted to save a few bucks a year.

Coverage B: Other Structures — this covers any structure on your property that is not permanently attached to your house, like fencing, driveways, sidewalks, and detached buildings like sheds and garages. Usually this coverage is 10% of whatever your Dwelling limit is, but can be increased if you need more coverage.

Coverage C: Personal Property — this covers all of your personal belongings like clothing, furniture, electronics, and appliances. Basically anything that would fall out of your house if you turned it upside down and shook out the contents. There are limits to high value items like jewelry, furs, cash, firearms, silverware, and certain electronics. Most of these are capped at $1,500 with an HO-5. If you want more coverage for these risky, easily stolen possessions, you can add them to your policy or get a seperate policy to protect them in case something happens.

Coverage D: Loss of Use — this covers your living expenses if you need to live somewhere else temporarily because your primary home is uninhabitable due to a loss.

Additional Coverages are listed below.

Medical Expense —this covers medical expenses for guests if they are injured on your property, and in certain cases covers people who are injured off of your property. It does not cover health care costs for you or other members of your household.

Family/Personal Liability — Personal Liability Coverage applies if someone is injured or their property is damaged and you are to blame. The coverage generally applies anywhere in the world. When choosing your liability coverage limits, consider things like how much money you make and the assets you own. Your personal liability coverage should be high enough to protect your assets if you are sued. In some situations, an Umbrella policy may be necessary to provide extra coverage.

Scheduled Personal Property — there are some situations where you might want special coverage for valuables, or collectibles like jewelry, guns, collectibles, rugs, etc. As mentioned above, you can add these items to your homeowners policy by “scheduling” them, or listing them for additional coverage. It usually doesn’t cost that much to make sure these precious things are protected from things like destruction by fire, loss by theft, or even sometimes just due to misplacement.

Let’s Talk.

It never hurts to have someone in your corner. Let’s chat and see how Alliance can help you protect your castle from, well, just about anything.

Fill out the form below and tell us a little about yourself so we know how amazing you are and what to call you. We’ll contact you ASAP and get you on the road to awesome coverage in no time.